Why Invest in Wine: The Unique Benefits

There are two separate groups in the wine world, those who love and appreciate great wines, and those who love great wines that appreciate. We are the second group.

Wine investors are not to be mistaken as sommeliers with vast amounts of knowledge about pairing the best foods with the correct wines or tasting for different flavors or notes with each sip or sniff. We will not be touching a drop of our wines, it is too good to just drink.

We are chasing those unicorn labels that are on the verge of exploding in value. Wine investors seek the rare and joyous moments of buying a bottle for under $100 from a relatively unknown winemaker and seeing it reach over $1,000 at auction a few years later.

And along the way it never hurts your pride or ego to be able to show a friend or work colleague your growing wine collection and innocently drop the phrase “You know there are only three bottles of this vintage left on the entire planet and I own one of them” This is guaranteed to add a level of perceived sophistication and depth to your personality as well as a little well earned envy from friends.

Investing in wine as a side hustle can give you both an incredible return on your investment and an enjoyable side hobby as you scour the vineyards around the globe looking for the next un-discovered gem.

How to Start Investing in Wine: Essential Steps

Now that we’ve established why the world of wine investment is worth exploring, let us dare to venture into the labyrinth, armed with our beginner’s guide to wine investment. If your palate is yearning for a taste of this intriguing pursuit, I’m here to dish out some essential steps on how to start investing in wine.

First things first: approach it like any other business venture or investment strategy.

Approach it with precision, deliberation, and a modicum of prudence thrown in for good measure. You cannot just saunter into the universe of bottle investments, waving a fistful of dollars and expect the Wine Market Gods to shower you with lucrative returns!

No siree! The path towards successful wine investments has more twists than a vineyard’s gnarled grapevine!

Create your own roadmap – your personalized wine investment strategy. This isn’t just about picking out pretty labels or choosing wines you might enjoy at your next dinner party; this is serious business!

I want you to be as meticulous as a sommelier scrutinizing his cellar — study those wine ratings, understand vintage charts, learn about different regions and styles. Your decisions should be based on solid research rather than the fickle whimsy of personal preference.

Or you could just take the quick and easy road and subscribe to our free weekly newsletter which show exactly what wines we have discovered or are adding to our wine collections. Press the button below to subscribe

The Crucial Ingredients For An Investment Grade Wine

Choosing the right wine isn’t just about picking the prettiest label, nor is it just about picking the most expensive wines on the shelf.

A lot of the time the best wines to invest in never actually make it to the retail level. They are on waiting lists that you need to get on to even stand a chance at getting a bottle.

Below is a list of things that your prospective bottle of wine has to tick to be considered an “Investment Grade Wine”

Reputation of the Producer: The vineyard or wine producer’s reputation plays a crucial role in the potential value of a wine. Certain producers consistently create high-quality wines that are sought after by collectors and enthusiasts. Ideally you are looking for a winemaker that has such integrity that they would rather destroy a batch of wine because it doesn’t meet their high standards rather than bottle it and hope for the best.

Vintage: The year of production or “vintage” significantly impacts a wine’s investment potential. Certain years are known for higher quality due to various factors such as weather conditions and the grapes’ overall health. Websites like Wine Enthusiast offer vintage charts that provide a year-by-year guide to the overall quality of wines from different regions.

Wine Region: Some regions are more known for their investment-grade wines. For example, Bordeaux and Burgundy in France, Tuscany in Italy, and Napa Valley in the USA are renowned for their high-quality, collectible wines.

But their are certainly regions that are quickly gaining a reputation for exceptional quality wines, such as New Zealand, Australia, Chile, Argentina and South Africa to name just a handful.

Rarity and Exclusivity: Limited edition wines or wines from smaller batches often increase in value over time. The rule of supply and demand applies here – fewer bottles in circulation can drive up demand and thus price.

Wine Ratings: Wines that receive high scores from critics and professional bodies (like Robert Parker’s Wine Advocate and Wine Spectator) often have a better chance of appreciating in value. High scores often create demand, especially among collectors.

Ageability: Not all wines are designed to age, and many are meant to be consumed within a few years of bottling. However, wines that are known to improve with age (and are properly stored) have a better chance of increasing in value.

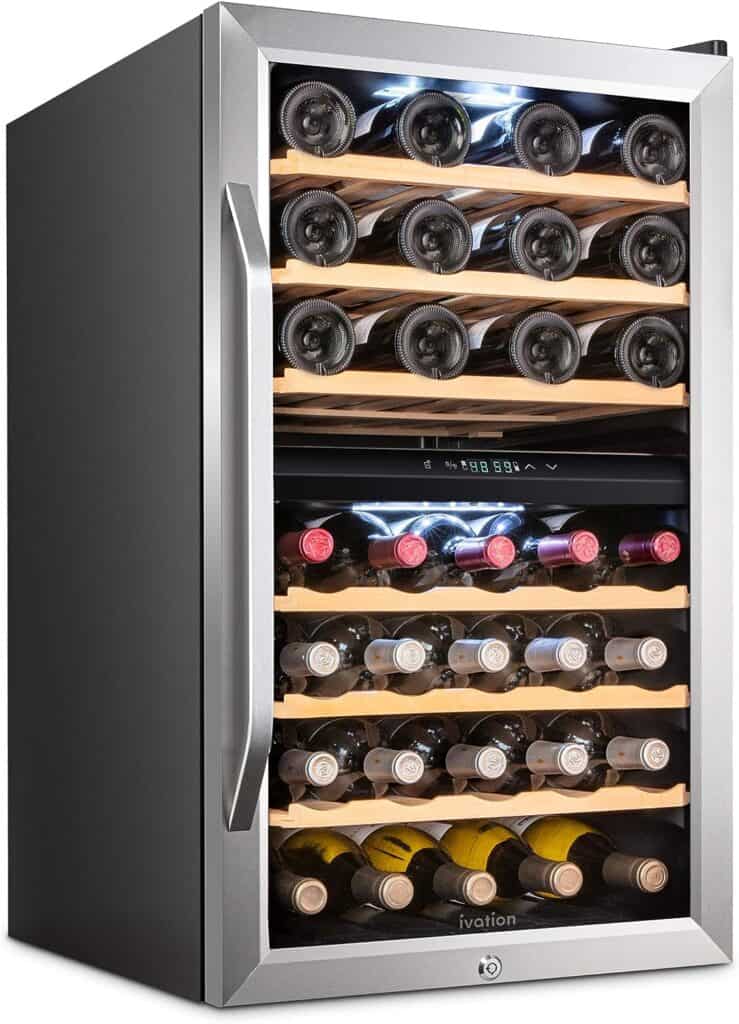

Storage Conditions: The way a wine is stored affects its ability to age and, ultimately, its potential for investment. Wines need to be stored under specific conditions – at the right temperature, humidity, and light levels – to preserve their quality.

Market Trends: Being aware of market trends can also be beneficial. Certain varietals or styles may be more popular at different times. For instance, Burgundy wines have seen a significant rise in popularity and value in recent years.

All your wine has to do is tick each one of the above conditions and you have a wine that will automatically improve in value as it ages. Simple yes? Simple, but my no means is it easy.

Understanding Wine Valuation: Factors That Impact Wine Prices

Of course, not everyone understands the time-honored tradition that is wine valuation – it’s an art form draped in mystery and allure. Yet, it’s a crucial aspect of any fine wine investment strategy.

The intricate ballet of factors affecting the price of vintage wine. It’s quite simple when you catch on; quality and scarcity drive wine prices upward.

High-quality wines are produced in limited quantities and as bottles are consumed with time, the remaining ones become more valuable due to their rarity. This particular phenomenon makes investing in wine such an appetizing prospect for those with a keen sense for business opportunities.

Equally critical to understanding the concept of wine valuation is acknowledging the influence of critics’ ratings on vintages’ market values. A highly-rated bottle from a well-respected critic can send prices soaring almost overnight – it’s like having Midas’ touch but instead of gold, we’ve got liquid ruby encased within glass walls!

Yet here’s where things get truly interesting…Where there’s risk there are also rewards; eye-watering financial windfalls await those who dare venture into this world- often considered elitist yet undeniably fascinating.

Investing in rare wines requires knowledge—this isn’t your ‘pub trivia’ type knowledge but rather akin to writing your thesis on how ‘bottle investment’ is like playing chess against Dionysus himself.

Investing in Wine vs. Traditional Investments: A Comparative Overview

It is indeed a fascinating world we inhabit, where one can turn a passion for the ambrosial nectar that is wine into a tangible, lucrative investment strategy. But as we dive headfirst into this delightful realm of wine investment, it’s crucial to draw parallels and contrasts with more traditional investments. It’s a battle of titans: Investing in Wine versus Traditional Investments.

Let me make something clear right from the onset! The Beginner’s Guide to Wine Investment would be decidedly incomplete without acknowledging the unique appeal of Investment Grade Wine.

As opposed to your run-of-the-mill stocks and bonds, each Bottle Investment carries an inherent allure – it’s not just a financial asset—it’s an exquisite product of nature and human craftsmanship. Whoever coined the term ‘safe as houses’ clearly hadn’t considered the potential returns on Fine Wine Investment.

In fact, over recent decades, wine investment returns have often surpassed those from equity markets. The numbers don’t lie!

But there is more than meets the eye in this venture; it demands patience akin to watching grapes ripen on their vine. Nonetheless, when one considers that they are investing not just in numbers but tangible products whose value can only appreciate with age—it becomes clear why many are turning towards this tantalizing industry.

The global Wine Market has matured and become more accessible than ever over recent years—making investing in wine increasingly attractive compared to traditional portfolios filled with standard assets such as stocks or real estate. Whether you choose to invest through an established Wine Investment Fund or curate your own portfolio by selecting individual wines for purchase—the choice is yours!

| Wine Investment | Traditional Investment (Stocks, Bonds etc.) | |

|---|---|---|

| Pros | ||

| 1. | Potentially high returns, particularly for rare and sought-after wines | More liquidity – stocks and bonds can be bought and sold easily on the open market |

| 2. | Not directly correlated with traditional financial markets | Greater variety of investment options |

| 3. | Offers a tangible asset that can be enjoyed personally | Well-established infrastructure for buying, selling, and managing investments |

| 4. | Adds diversification to an investment portfolio | Regular dividends or interest payments can provide a consistent income stream |

| 5. | Can appreciate in value even during economic downturns | Easier to analyze based on company performance, economic indicators, etc. |

| Cons | ||

| 1. | Requires specific knowledge about wines | Affected by overall market volatility |

| 2. | Storage and insurance costs can be high | Can require a significant initial investment |

| 3. | Illiquid asset – can take time to find a buyer | Subject to capital gains tax |

| 4. | Risk of counterfeit bottles | Investments can depreciate in value due to poor company performance |

| 5. | No regular income stream (like dividends or interest from stocks/bonds) | Can be complex and confusing for new investors, especially without professional advice |

*Please remember that this table only provides a generalized overview. Both forms of investment have many variables and risks, and potential investors should seek professional advice before making any decisions.

All said—when juxtaposed against traditional means such as equities or real estate—the compelling case for Investing In Fine Wines becomes evident—for what other asset offers you such intoxicating mix—intricate flavors paired exquisitely with potentially mouth-watering returns?

So go ahead–imbibe knowledge about this fine craft and join me again next time as we uncork further insights about navigating this enchanting journey called “Wine Investing!”.

Risks of Wine Investment: What New Investors Should Know

Venturing into the world of wine investment risks can feel like a heady, intoxicating journey, but it is imperative to remain clear-headed. Beware of those who present a rosy picture of endless riches and never mention the potholes along the way.

Investing in wine is not all sipping sumptuous vintages in sun-drenched vineyards; it’s a serious business, fraught with challenges as much as it is ripe with opportunities.

The complexities involved in this bottle investment game cannot be overstated. Mighty oenophiles have fallen prey to the merciless snares of unregulated wine auctions, seduced by the allure of snagging rare wines at bargain prices.

My fellow vino investors, let’s not forget that when something sounds too good to be true – it probably is! Wine auctions are notorious breeding grounds for counterfeiters peddling their nefarious wares.

It’s sadly too easy for these scoundrels to repackage plonk as priceless vintage wine.

There’s also another gnawing concern when it comes to fine wine investment: Storage!

I’ve seen countless investments sour due to ill-maintained conditions. Wine cellaring isn’t just about stashing your precious bottles away in some dimly lit room hushed with secrets; this isn’t some romanticized tale spun by dreamers and poets!

The harsh truth is that improper storage can turn an investment-grade wine into a disastrous disappointment faster than you can say ‘Corked!’ And then we have these so-called ‘wine investment funds.’

The financial gurus might try to sell you on their stable returns and sophisticated portfolio management, but do you think they actually care about your beloved grapes?

They’re more likely to know about bull markets than Bordeaux and bear markets than Burgundy! Wine as an asset isn’t just figures on a ledger; it’s living history encapsulated in glass.

Nevertheless, despite all its apparent perils and pitfalls, investing in wine still holds an undeniable allure for many. And why wouldn’t it?

There exists no other asset so steeped in culture and history that has such potential for exponential growth. In navigating this labyrinthine landscape of bottle investments and vineyard valuations, having a well-thought-out wine investment strategy becomes essential – especially if you’re treading into these complex terroirs as a beginner.

While our Beginner’s Guide to Wine Investment may not promise sunshine-dappled vineyards without obstacles or challenges, what we do pledge is honesty about those wine market risks and rewards that lie ahead on this fascinating journey toward becoming astute investors within the world of fine wines.

Above all else: Knowledge truly becomes your best partner when dancing around those potential missteps one could encounter upon entering the illustrious realm of wines.

Spotting the Next Big Vineyard: Tips for Successful Wine Investment

Wine investment isn’t for the half-hearted or the short-sighted. It’s not enough to simply love a good vintage and to have a healthy bank account.

Investing in wine is as much about finding hidden gem wineries as it is about understanding rare wine valuation. Some novice investors think you can make substantial wine investment returns by throwing money at any old vineyard that catches your fancy, but that couldn’t be further from the truth!

Indeed, it’s not enough to simply point at a map of France or California and invest in vineyards willy-nilly. In reality, successful bottle investment takes acute knowledge of various factors: from climate patterns to soil quality; from cultivation methods to vintage variations; from costing models… right down to how well a winery handles its post-harvest processes like fermentation and aging – an integral part of any fine wine investment strategy.

Not all vineyards are created equal – some are destined for greatness while others might be better suited for making cooking wines! Furthermore, maintaining an effective wine portfolio demands proper storage considerations – or should I say ‘wine cellaring’?

If you’re sinking cash into a high-end Merlot or Chardonnay without planning on how you’re going to store these liquid treasures appropriately… well then dear reader, you might as well donate your hard-earned funds straight into my own personal wine investment fund because at least I understand how critical optimal storage conditions are when investing in vintage varieties!

The perils range from global market flux influencing prices to potential bottle spoilage destroying your hard-earned investments overnight – indeed Wine Investment Risks are very real. To navigate this often daunting terrain requires vast knowledge about everything vinous.

One needs insider information about looming trends within this volatile market landscape; subtle shifts that could skyrocket specific varietals into stratospheric demand – thus ensuring mind-blowing returns on your investment grade wines if timed perfectly. Yet importantly: auctions – oh glorious Wine Auctions!

A thrilling playground where fortunes can be multiplied exponentially within mere minutes. But beware: such heady excitement can easily lead new investors astray unless armed with solid insights about fair valuations for those rare bottles up on offer.

So there you have it – successful investing in wine isn’t just about purchasing pricey Pinots and costly Cabernets hoping they’ll appreciate over time while being stored under ideal conditions (although that’s certainly part of it).

It involves developing an extensive understanding of viticulture dynamics across different regions as well as keeping tabs on global developments which could influence overall market trends – both aspects critical components within any savvy investor’s robust Wine Investment Strategy.

If doing all this research manually and combing though hundreds if not thousands of different wineries looking for that hidden diamond in the rough sounds a bit too much, then you might enjoy our free weekly newsletter where I report our best wine of choice two weeks before I publish it on this website.

The Role of Vintage and Terroir in Wine Investment

Ah, the allure of vintage and terroir in wine investment! It’s a heady blend, intoxicating and potentially rewarding.

But let’s dive deeper for a moment. You see, vintage wine isn’t just about dusty bottles and past centuries – it’s about understanding the nuanced interplay of seasonality, weather patterns and their profound influence on viticulture!

Vintage is often recklessly bandied about in wine auctions as if it was some magical stamp of unrivaled excellence. Newsflash – not every old bottle is gold!

To truly invest in vineyards with possibilities of exceptional vintages, you must be prepared to delve into meteorological reports, scrutinize the impacts of sunshine hours on grape maturation or even rain’s role in vine disease risk. And then there’s terroir.

Winemakers from Burgundy to Barolo wax lyrically about this mystical concept as if it’s some divine secret understood only by them. In truth, terroir is soil type, climate (micro and macro), sunlight exposure – all the environmental factors that contribute to grape characteristics.

When investing in wine for your well-diversified portfolio, never underestimate the role of terroir.

Final Things to Consider

In the winding, tumultuous, yet oddly alluring venture that is the wine investment market, we’ve traipsed through vineyards and cellars. Now, as we lay our corkscrew aside and draw this journey to a close, let’s pour ourselves a glass of perspective. The dance of wine as an asset is a peculiar one indeed.

It’s not for everybody, and it certainly bares its fangs to those who enter without caution or respect. Investing in wine can be intoxicatingly rewarding – the allure of rare wine standing tall in your portfolio can make even the most stoic of investors blithely giddy.

But one mustn’t get lost in the romantic swirl of ‘investment grade wine’. This is no trite affair; treat it as such and you risk bleeding more than just money.

One also mustn’t forget that behind every bottle investment lays not only an expectation for profit but also an intricate web of considerations.

The game isn’t as simple as stashing bottles away in your cellar and selling them off at some distant future auction. Wine investment risks are very real – they breathe down your neck like a sommelier pushing for an expensive recommendation.

But let me tell you something: the thrill isn’t just in turning a profit or watching your investment grade wines appreciate over time – there’s something deeply satisfying about holding that vintage bottle in your hand knowing that it could be worth significantly more than what you initially shelled out for it at some swanky auction.

And yet, amidst all this talk about buying low and selling high on wine auctions or investing through a dedicated Wine Investment fund – I’d still profess that investing directly into vineyards holds its own charm—a primal connection to the earth, if I may wax poetic momentarily.

There’s something palpable about owning a tangible piece of land where gorgeous grape vines thrive and yield excellent vintages year after year. It’s akin to owning shares in a well-performing company but with added dirt under your nails—an investor would find such visceral satisfaction hard-pressed elsewhere!

However, remember this: even with all these voluble words spilled over onto pages about beginner’s guide to wine investments or how-to-guides on building impressive fine-wine portfolios—not everything will be applicable uniformly across different investors’ scenarios.

The key lies within understanding yourself first—your risk appetite, financial capacity, knowledge level etc., before plunging headfirst into this tempestuous sea called ‘Wine Market.’ While fraught with potential pitfalls on one side—it also bears an enticing promise of rich returns on another!

As our glasses clink together at this juncture—know that with each sip from an extraordinary vintage earned through clever navigation—you’re savoring not just exquisite flavor—but also sweet success built upon calculated strategies! Now isn’t that enough reason to raise another toast?